The UK Co-Living Market

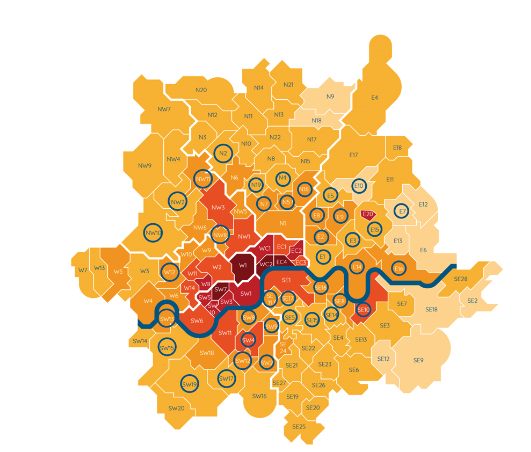

According to the Office for National Statistics, 515.000 people are in shared accommodation in London - this number is based on 2.5 persons per dwelling and only covers licensed HMOs, which are only a fraction of the market. Taking these factors into consideration, we estimate that the market could be up to three times larger than this.